Navigating the world of disability insurance claims can be challenging, especially when your disability benefits have been denied or terminated. Whether you're working with an attorney or going it alone, there are four essential documents you must obtain to improve your chances of a successful appeal.

Let's dive into the documents needed for your disability benefits appeal!

1. A Copy of Your Complete Insurance Policy - Many employees only receive a summary of their disability insurance plan, but to appeal a denial or termination effectively, you'll need the entire policy. Here's what you should look for:

- Statute of Limitations: Find out the time frame you have to file a claim or an appeal. Strict rules apply, so understanding and following them is crucial.

- Definition of Disability: Each policy defines disability differently, often comparing it to your job description and earnings. Pay attention to the terms related to your ability to perform the essential duties of your job and any income reduction requirements.

- Coverage Period: Know how long you can be covered under the policy if you're found disabled.

- Short-term disability coverage typically lasts 12-26 weeks before transitioning to long-term disability if applicable. Be aware of any limitations for mental health conditions and the change in eligibility criteria after one to two years.

- Pre-existing Conditions and Date of Eligibility: Check if there are waiting periods before your coverage starts and any exclusions for pre-existing conditions. Some policies may not cover conditions that existed before your employment or insurance under the plan.

- Offsets: Understand the list of offsets the insurance company can use to reduce your benefits, including social security, other insurance policies, or even withdrawals from retirement funds.

- Limitations to Coverage: Be aware of exclusions for work-related injuries or illnesses. There may be exceptions, so know the rules. For instance, if your workers' compensation claim is denied, you might be eligible for short-term disability while you appeal the workers' compensation decision.

2: Your Job Description and Personnel File - When preparing to appeal a denied disability claim, your job description and personnel file are vital. They help demonstrate your inability to perform the essential duties of your job due to your disability.

Here's what you should do:

- Request Your Personnel File: Begin by obtaining copies of your personnel file, which includes details about your employment history, evaluations, and any disciplinary actions.

- Obtain Your Written Job Description: Get a copy of your job description, as it outlines the specific tasks and responsibilities associated with your position. Your attorney will analyze this document to identify essential duties you can no longer perform due to your disability.

- Provide Evidence of Work-Related Struggles: To establish eligibility for disability insurance benefits, you must demonstrate that you struggled at work, failed to meet expectations, or encountered difficulties completing tasks.

- Gather evidence such as performance reviews, work-related emails, and any documentation reflecting these challenges.

- Rely on Medical Evidence: Medical evidence is crucial in supporting your disability claim. Consult your physician, who can review your job description and offer their professional opinion on tasks you can't perform due to your medical condition.

- Highlight Discrepancies: Your attorney will scrutinize the discrepancies between your job requirements and your abilities resulting from your disability. Any tasks in your job description that you can't perform are essential for your appeal.

- Document Missed Work and Productivity Decline: Keep records of missed work days and declining productivity, as this evidence links your disability to work-related issues.

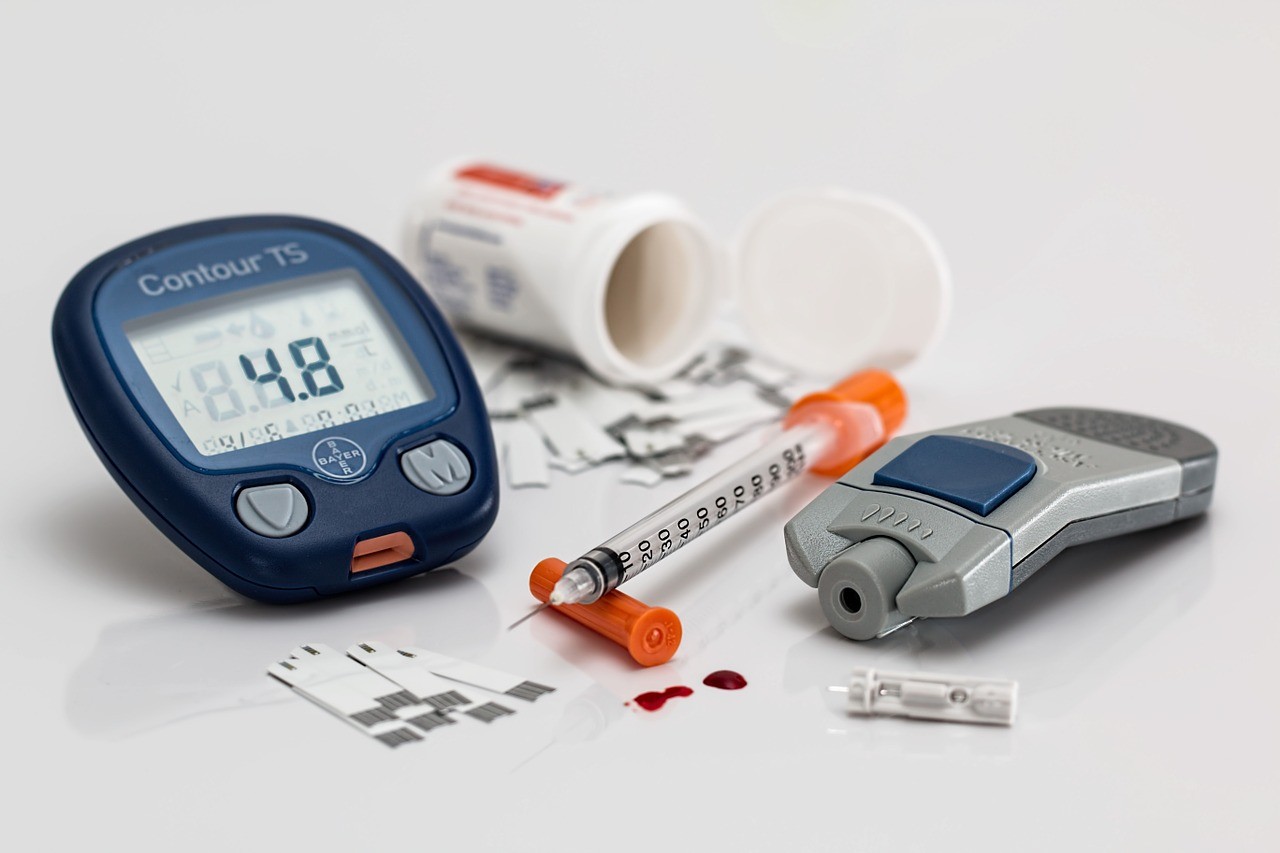

3: Gathering Your Complete Medical Records - One of the most common reasons for denied disability claims is incomplete medical records. You can improve your appeal by obtaining your complete medical records. Here's how: